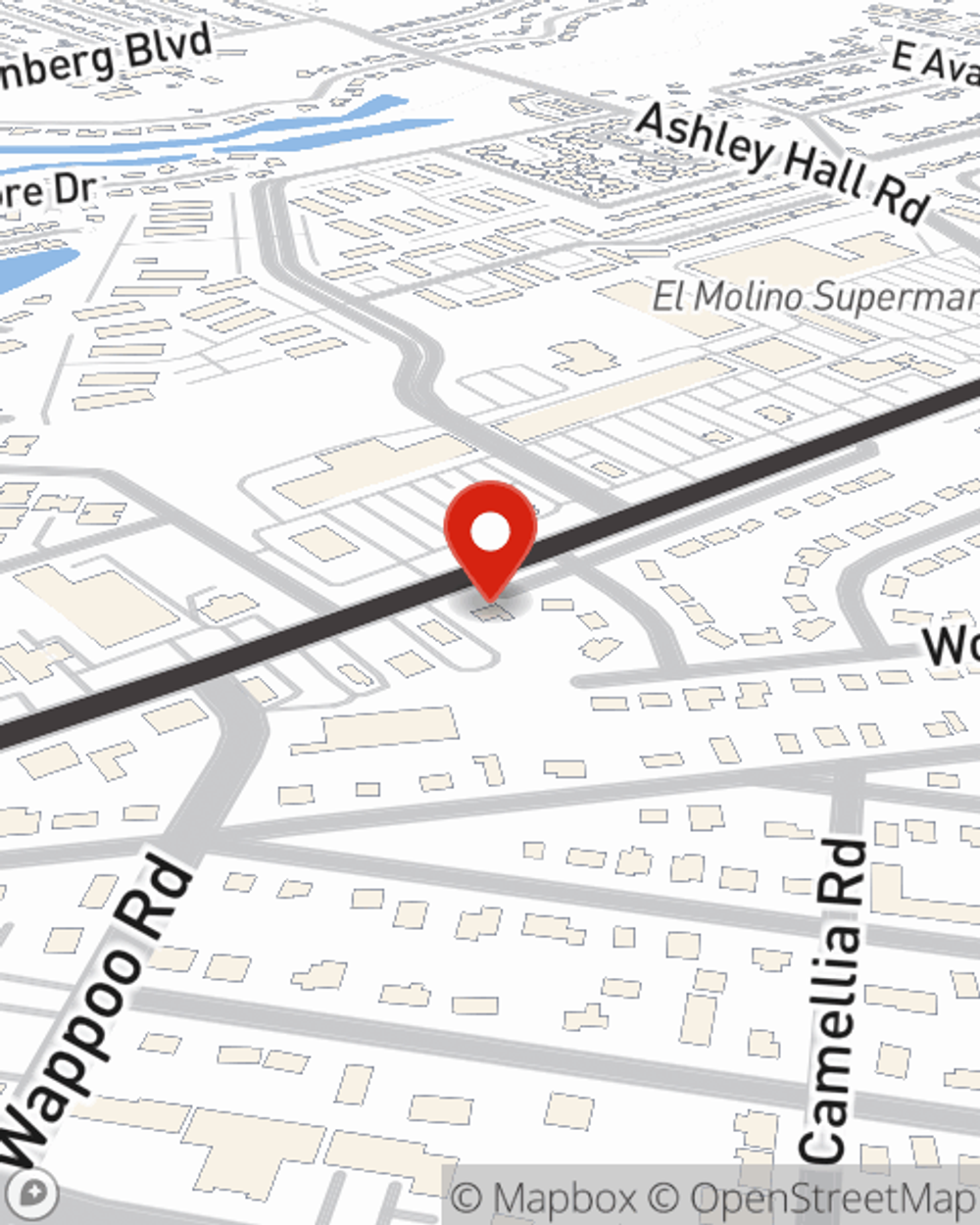

Business Insurance in and around Charleston

One of the top small business insurance companies in Charleston, and beyond.

Insure your business, intentionally

- Columbia

- Mt Pleasant

- Daniel Island

- Johns Island

- James Island

- Summerville

- Georgetown

- Goosecreek

- Greenville

- Charlotte

- Willmington

- Bluffton

- Winston Salem

- West Ashley

- Moncks Corner

- Conway

Business Insurance At A Great Price!

Running a small business is hard work. Finding the right coverage should be the least of your worries. State Farm insures small businesses that fall under the umbrella of specialized professions, contractors, retailers and more!

One of the top small business insurance companies in Charleston, and beyond.

Insure your business, intentionally

Surprisingly Great Insurance

Your business is unique and faces a wide array of challenges. Whether you are growing a pizza parlor or a book store, State Farm provides a large range of small business insurance options to help your business thrive. Depending on your business type, you may need more than just business property insurance. State Farm Agent Windy Plank can help with a surety or fidelity bond as well as key employee insurance.

With over 300+ businesses eligible to be insured by State Farm, look no further for your business coverage needs. Agent Windy Plank is here to help you review your options. Get in touch today!

Simple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.

Windy Plank

State Farm® Insurance AgentSimple Insights®

Strategic small business start-up tips

Strategic small business start-up tips

Tips to help you remove some risk from starting your small business.

Commonly asked Business Continuation questions

Commonly asked Business Continuation questions

Check out the answers to these commonly asked business continuation questions.

What you need to know about replacement cost vs market value

What you need to know about replacement cost vs market value

Learn the difference between replacement cost value and market value coverage to make an informed decision when purchasing home insurance.

Help save trees from the emerald ash borer

Help save trees from the emerald ash borer

This pest can kill your ash trees if given the chance, so learn more about identifying and staving off emerald ash borers.